Written by:

Written by:

Wesley Chua,

SCCV Executive Committee Member 2022-2024

This special alert highlights the key tax and non-tax measures impacting SCCV members with businesses in both Singapore and Vietnam.

On 14 February 2023, Singapore Deputy Prime Minister and Finance Minister Lawrence Wong delivered the annual Budget Statement for the Financial Year 2023. Budget 2023 contains many measures to help businesses build capabilities and seize new opportunities in an era of challenging macroeconomics development.

Below are some key measures impacting businesses followed by our comment. For further details on the tax changes and enterprise disbursements, please refer to Inland Revenue Authority of Singapore website.

Implementation of Minimum Taxation

In response to Pillar 2 of OECD’s Base Erosion and Profit Sharing (BEPS) 2.0 project, Singapore plans to implement the Global Anti-Base Erosion (GloBE) rules and Domestic Top-Up Tax (DTT) of 15% from businesses’ FY starting on or after 1 January 2025.

The Singapore Government will continue to monitor the international tax developments and adjust the implementation timeline as needed if there are delays. The Government will also review and update its broad suite of industry development incentives to ensure that Singapore remains competitive in attracting and retaining investments.

SCCV’s comment: Tax incentives have historically been an integral part of Singapore’s fiscal toolkit in attracting foreign direct investments (FDI). The introduction of a minimum tax therefore negates the benefits of preferential tax rates enjoyed by multinationals (MNEs). As such, MNEs should review their holding/ ownership structures and where each of their entities is located to assess if any part of their operations is bounded by the global minimum tax regime. The GloBE rules are extremely complex, and not identical to current tax laws nor do they follow accounting standards in all respects. Complying with these rules requires large amounts of data, not all of which is readily available in the current financial system. MNEs should make the most of the two-year lead time to prepare for this new tax regime.

Introduction of the Enterprise Innovation Scheme

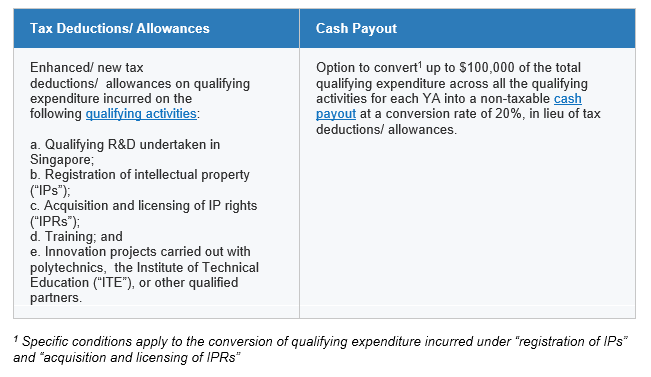

To encourage businesses to engage in R&D, innovation and capability development activities, the following tax measures will be enhanced or introduced under the Enterprise Innovation Scheme (EIS) from year of assessment (YA) 2024 to 2028:

SCCV’s comment: EIS scheme has been lauded as a bold move that will help local businesses continue to invest in innovation, at a time when many may be tempted to reel in their spending instead. On first glance, EIS scheme seems pretty similar to the previous Production and Innovation Credit Scheme which was available from YA 2011 to YA 2018. However, the EIS system is more targeted, with tax credits or tax exemptions increased to 400% of eligible expenses up to relevant thresholds depending on the type of activity. This is more generous than the 100% to 250 tax credit currently available.

Enhancement of the Double Tax Deduction for Internationalisation Scheme

Under the Double Tax Deduction for Internationalisation (DTDi) Scheme, businesses are allowed a tax deduction of 200% on qualifying market expansion and investment development expenses, subject to prior approval from Enterprise Singapore or the Singapore Tourism Board.

The scope of this scheme will be enhanced to include a new qualifying activity i.e., “e-commerce

campaign”, which will cover certain specified e-commerce campaign start-up expenses paid to ecommerce platform or service providers.

Prior approval is required from Enterprise Singapore to enjoy DTDi on the new qualifying activity. The enhancement will take effect for qualifying e-commerce campaign startup expenses incurred on or after 15 February 2023.

SCCV’s comment: The DTDi aims to encourage Singapore businesses to expand overseas. It allows approved businesses to deduct against their taxable income, twice the qualifying expenses incurred for qualifying activities. With the addition of e-commerce campaign as qualifying activities, the expenses covered now include e-commerce related business advisory, account creation, content creation, and product listing and placement expenses. Singapore-based businesses looking to expand into the Vietnam market should make full use of this scheme to reduce their taxable profit.

Extend and refine the Financial Sector Incentive (FSI) scheme

The FSI scheme currently accords concessionary tax rates of 5%, 10%, 12%, and 13.5% on income from qualifying banking and financial activities, headquarters and corporate services, fund management and investment advisory services. The FSI scheme is scheduled to lapse on 31 Dec 2023. To support the continued growth and expansion of financial activities in Singapore, the FSI scheme will be refined and extended until 31 Dec 2028.

SCCV’s comment: The expansion of the FSI program is in line with Singapore’s claim to being a major financial hub. With the upcoming global minimum tax regime expected to be introduced in other countries from 2024 and Singapore’s intention to implement it from 2025, the tax stimulus package by the FSI will become less important in attracting banks to Singapore. It remains to be seen if other factors will play a bigger role in attracting banks to stay or establish in Singapore. Expect the Monetary Authority of Singapore to publish details of the changes by May 2023.